Financial resources and news

Check in regularly for the latest financial resources and news. The financial industry is always changing, so we’ll keep you up to date about anything that may affect you, your family or your business. We’ll also post tips and advice about how to make your money work better for you.

Remember, if you have any questions, we’re always here to offer advice.

How to invest in commercial property

Maybe you’re a business owner tired of paying rent to a landlord when you could be building equity. Perhaps you’re an investor who’s done well

Refixing and refinancing your mortgage – what’s the difference?

While ‘refixing’ and ‘refinancing’ might sound similar, they’re quite different options – and understanding the difference could save you thousands of dollars. Think of your

Understanding reverse mortgages

When talking about retirement, there’s a tool that many homeowners may not be familiar with but could potentially be a game-changer, depending on your situation.

Which professionals do you need in your corner when buying a home?

Buying your first home can be confusing. Banks, lawyers, real estate agents … they all seem to want a piece of you. If you’re not

Investment update – November 2025

It’s been a really strong quarter for investors! Share markets around the world shot up, many funds grew by more than 5%, and for the

Why use a Mortgage Adviser

Around 60% of all home loans are put in place by a professional Mortgage Adviser. There are many benefits to using a Mortgage Adviser when buying

Reserve Bank to ease LVR restrictions

Starting 1 December 2025, the Reserve Bank of New Zealand is relaxing the rules around mortgage lending to make it easier for people to borrow

Job-hopping may affect your mortgage options

Are you a job-hopper or a long-termer? In the past, floating from job to job used to be a black mark on your CV, as

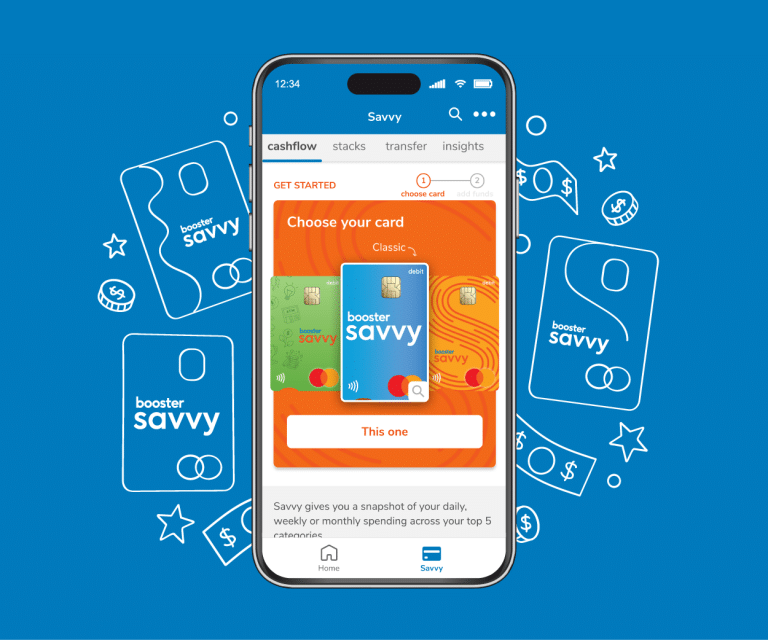

Boost your financial wellbeing with Booster Savvy and the Booster app

Imagine being able to monitor your total financial life from a single dashboard – including your KiwiSaver scheme, bank accounts, savings, debts, shares, property and

Cole Murray Financial Advisers are award winning

Our Financial Advisers work really hard for our clients, and the devil is very much in the detail in this industry. It’s a paper-work heavy

Why Insurance Advice from a professional beats DIY

Insurance decisions can feel overwhelming. With banks offering seemingly convenient packages and online platforms promising quick quotes, it’s tempting to take the easy path. But

What is the difference between stepped and level insurance premiums?

One of the key components in considering your life insurance is short and long-term affordability. t’s discuss the difference between, ‘Stepped’ and ‘Level’ premiums and